Letter of credit

[hide]This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages)

|

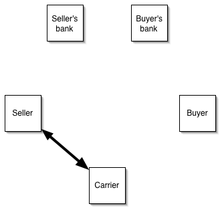

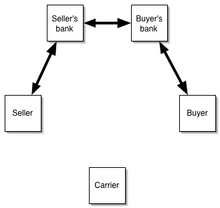

In modern business practice, a letter of credit (LC) also known as a Documentary Credit, is a written commitment by a bank issued after a request by an importer(foreign buyer) that payment will be made to the beneficiary (exporter) provided that the terms and conditions stated in the LC been met, as evidenced by the presentation of specified documents.[1]

A letter of credit is a method of payment that is an important part of international trade. They are particularly useful where the buyer and seller may not know each other personally and are separated by distance, differing laws in each country and different trading customs.[2] It is generally considered that Letters of Credit offer a good balance of security between the buyer and the seller, because both the buyer and seller rely upon the security of banks and the banking system to ensure that payment is received and goods are provided.[3] In a Letter of Credit transaction the goods are consigned to the order of the issuing bank, meaning that the bank will not release control of the goods until the buyer has either paid or undertaken to pay the bank for the documents.

In the event that the buyer is unable to make payment on the purchase, the seller may make a demand for payment on the bank. The bank will examine the beneficiary's demand and if it complies with the terms of the letter of credit, will honor the demand.[4] Most letters of credit are governed by rules promulgated by the International Chamber of Commerce known as Uniform Customs and Practice for Documentary Credits.[5] The current version, UCP 600, became effective July 1, 2007. Banks will typically require collateral from the purchaser for issuing a letter of credit and will charge a fee which is often a percentage of the amount covered by the letter of credit.

No comments:

Write comments